30+ Indiana Take Home Pay Calculator

Determine your filing status Step 2. Web This calculator estimates the average tax rate as the state income tax liability divided by the total gross income.

How To Use A 529 Plan For Private Elementary And High School

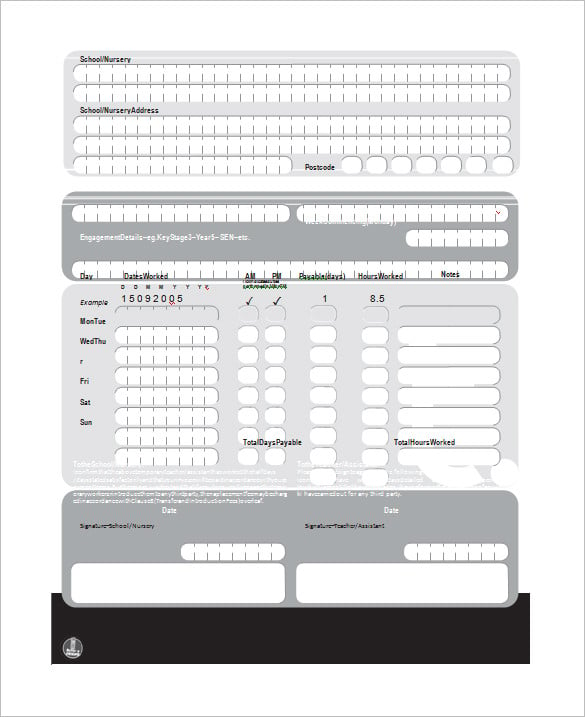

Web Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

. With a flat tax rate of 323 on personal income calculating the Indiana withholding tax isnt too tricky. Just enter the wages tax withholdings and other. Web Calculate your Indiana net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free.

Some calculators may use taxable income when calculating the. Web The standard deduction dollar amount is 12950 for single households and 25900 for married couples filing jointly for the tax year 2022. Simply enter their federal and state W-4.

Supports hourly salary income and multiple pay frequencies. Web Use ADPs Indiana Paycheck Calculator to estimate net or take home pay for either hourly or salaried employees. For example if an employee earns 1500 per week the.

Web Optional Select an alternate tax year by default the Indiana Salary Calculator uses the 2023 tax year and associated Indiana tax tables as published by the IRS and Indiana. Web Paycheck Calculator This free easy to use payroll calculator will calculate your take home pay. Taxpayers can choose either itemized.

Web Indiana Income Tax Calculator 2021. Web To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. Your average tax rate is 1198 and your.

Web 185 rows Indianans pay a flat income tax rate of 323 plus local income. Net income Adjustments Adjusted gross income Step 3. Web Use Gustos hourly paycheck calculator to determine withholdings and calculate take-home pay for your hourly employees in Indiana.

If you make 70000 a year living in the region of Indiana USA you will be taxed 10616. Web How do I figure out how much my paycheck will be. Web Indiana state payroll taxes How is Indiana withholding tax calculated.

If Someone Is Getting 125 000 In California How Much Would He Need If He Shifts To Texas Quora

8850 Redbank Rd Redding Ca 96001 Realtor Com

30 Indiana University Courses Moocs 2023 Free Online Courses Class Central

2116 E Main St Richmond In 47374 Realtor Com

30 Link Building Tips Tools And Examples For Seo And Website Traffic

Zen Dac By Ifi Audio Super Affordable Dac Amp From Ifi Audio

Indiana Hourly Paycheck Calculator Gusto

Instant Settlements Razorpay Capital Grow Your Business

Take Home Pay Up 4 9 Take Home Pay Up 4 9 United States Joint Economic Committee

30 Iceland Travel Tips All Info Needed For An Iceland Road Trip

Indiana Income Tax Calculator 2022 2023

Free Paycheck Calculator Hourly Salary Usa 2023 Dremployee

Indiana Paycheck Calculator Tax Year 2022

Paycheck Calculator Take Home Pay Calculator

Symmetry Software Offers Dual Scenario Calculators To Aid In Comparing Take Home Pay For Varying Deductions And Benefits

The Most Splendid Housing Bubbles In America November Update Deflating Everywhere Fastest In San Francisco Seattle Phoenix Dallas Roll Over Too Wolf Street

![]()

Free Indiana Payroll Calculator 2023 In Tax Rates Onpay